![]()

See this visualization first on the Voronoi app.

Use This Visualization

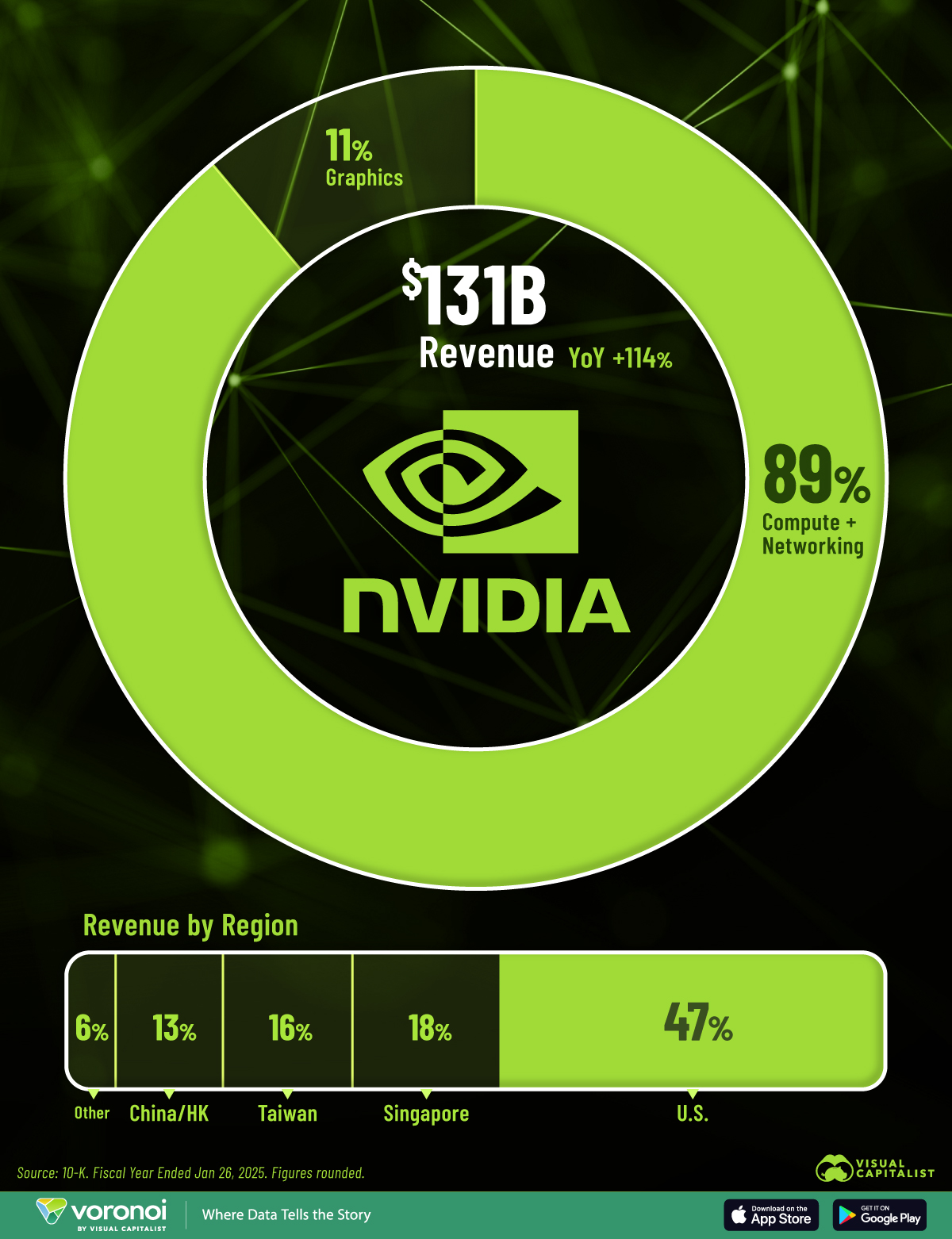

Visualizing Nvidia’s Record $131 Billion in Revenues

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Key Takeaways

- Nvidia saw revenues soar to a record $130.5 billion in the fiscal year ending in January.

- In the last quarter, its next generation Blackwell chips drove roughly a third of its data-center revenues.

- Nearly half of revenues were generated from the U.S., followed by 18% from Singapore, a global hub for billing centers.

.key-takeaways {

background: #F8F9FA;

border-left: 4px solid #2A6338;

padding: 15px;

margin: 20px 0;

border-radius: 5px;

}

.key-takeaways h3 {

margin-top: 0;

color: #2A6338;

font-weight: bold;

}

.key-takeaways ul {

padding-left: 20px;

}

.key-takeaways li {

margin-bottom: 5px;

}

In its latest fiscal year, Nvidia’s revenue surged 114% to reach a record $130.5 billion.

While the company doesn’t disclose specific customers, three major buyers made up over a third of annual revenue—likely including tech giants like Meta, Alphabet, or Tesla. Demand for its newest Blackwell chips fueled sales, while chips for vehicles and robots were other key growth segments.

This graphic shows Nvidia’s revenue breakdown, based on its latest 10-K filing, which is its full-year annual earnings report.

Nvidia’s Revenue Breakdown by Business Segment

Below, we show how the vast majority of Nvidia’s revenue is from its compute and networking division, which includes AI processors and architecture used in data centers.

| Category | Revenue Fiscal Year Ended January 26, 2025 | Share of Revenue |

|---|---|---|

| Compute & Networking | $116.2B | 89% |

| Graphics | $14.3B | 11% |

| Annual Revenue | $130.5B | 100% |

Figures are rounded.

As we can see, Nvidia generated $116.2 billion from this segment as companies required a growing number of chips for their AI models.

For instance, Meta and Elon Musk’s xAI announced they were using super clusters of Nvidia chips to produce AI models at a faster clip. These clusters, which use up to 100,000 AI chips, are connected by high-speed networking cables. Furthermore, big tech firms could require clusters of 300,000 chips in the next year.

Also driving demand are Nvidia’s Blackwell chips, which launched in March of last year. As its most advanced chips, they are estimated to cost $30,000 each, which would total approximately $3 billion for a 100,000 chip cluster.

Meanwhile, chips for vehicles increased 103% year-over-year as of the fourth quarter to reach $570 million.

Nvidia’s Revenue Breakdown by Country

As the table below shows, the U.S. stands as Nvidia’s top market, making up 47% of sales:

| Region | Revenue | Share of Revenue |

|---|---|---|

| U.S. | $61.3B | 47% |

| Singapore | $23.7B | 18% |

| Taiwan | $20.6B | 16% |

| China (including Hong Kong) | $17.1B | 13% |

| Other | $7.9B | 6% |

Figures are rounded.

Following next in line is Singapore, generating nearly a fifth of annual sales, based on customer billing location.

However, just 2% of revenue represented chips actually shipped to the country. Recently, three people have been arrested in Singapore for misrepresenting the final destination of Nvidia chips potentially contained in server computers worth $390 million. In turn, the discrepancy has raised concerns that the country serves as a conduit for shipping chips to Chinese firms, such as DeepSeek.

Learn More on the Voronoi App ![]()

To learn more about this topic from a customer-based perspective, check out this graphic on the top buyers of Nvidia’s H100 chips.

The post Charted: How Nvidia Makes Its $131 Billion in Revenue appeared first on Visual Capitalist.