Published

24 mins ago

on

August 26, 2025

| 56 views

-->

By

Alan Kennedy

Article & Editing

- Cody Good

Graphics & Design

- Athul Alexander

The following content is sponsored by Empower

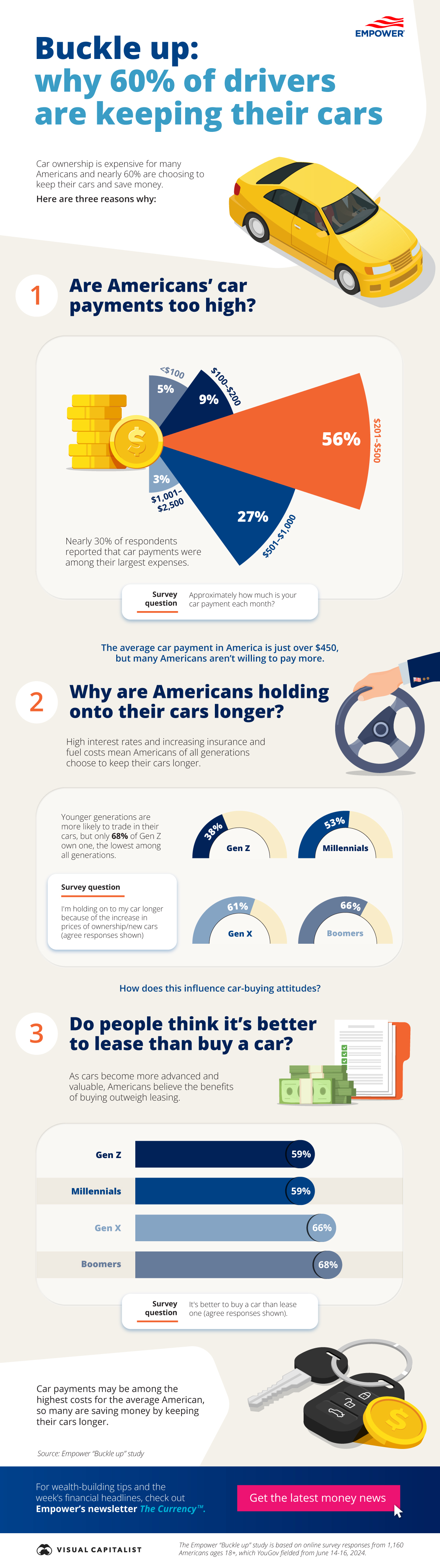

Car ownership costs: Why 60% of drivers are keeping their cars

Key Takeaways

- Nearly 30% of respondents said car payments rank among their largest expenses.

- Younger generations are more likely to trade in their cars, but only 68% of Gen Z own one, the lowest rate across all generations.

- As cars grow more advanced and valuable, Americans believe buying offers greater benefits than leasing.

From Boomers to Gen Z, drivers are reshaping the road ahead in response to increasingly expensive car ownership costs. Nearly 60% of Americans now keep their cars longer to manage rising interest rates, insurance premiums, and fuel prices.

This graphic, created in partnership with Empower, visualizes how Americans are adjusting ownership habits to navigate tighter budgets.

The growing weight of car costs

With the national average car payment just above $450, nearly 30% of respondents said these payments are one of their top financial burdens.

| Car payment range | % share |

|---|---|

| < $100 | 5% |

| $100 - $200 | 9% |

| $201 - $500 | 56% |

| $501 - $1000 | 27% |

| $1001 - $2500 | 3% |

A closer look at monthly payment data shows that more than half of respondents pay between $201 and $500 each month. Another 27% spend between $501 and $1,000, which helps explain why many hesitate to pay more.

Car ownership habits by generation

High interest rates and rising insurance and fuel prices are prompting Americans of all ages to keep their cars longer to reduce their car ownership costs.

| Age range | % share | |||

|---|---|---|---|---|

| Gen Z (18-26) | 38% | |||

| Millennial (27-42) | 53% | |||

| Gen X (43-57) | 61% | |||

| Boomer (58-76) | 66% | |||

| Silent Age (77+) | 71% |

Depending on age, anywhere from half to more than two-thirds of Americans plan to hold onto their cars longer. Gen Z trails at just 38%. This may reflect lower access since only 68% of Gen Z own a car at all, compared with nearly universal ownership among older groups.

Americans choose ownership over leasing

Across generations, Americans strongly prefer owning over leasing.

| Age Range | % Share | ||

|---|---|---|---|

| Gen Z (18-26) | 59% | ||

| Millennial (27-42) | 59% | ||

| Gen X (43-57) | 66% | ||

| Boomer (58-76) | 68% | ||

| Silent Age (77+) | 73% |

As cars become more advanced and valuable, the data shows most drivers believe buying outweighs leasing.

Since car payments are among the highest costs for the average household, many are trying to save on car ownership costs by extending the lifespan of their vehicles.

For wealth-building tips and the week’s financial headlines, check out Empower’s newsletter The Currency.

Source: Empower’s ‘Buckle Up’ study, based on online survey responses from 1,160 Americans ages 18+, which YouGov fielded from June 14-16, 2024.

More from Empower

-

Personal Finance6 days ago

Retirement Savings: Reaching the ‘Magic Number’

The average American expects to have only a quarter of the retirement savings they will need before they retire. How can they bridge the gap?

-

Money6 months ago

Ranked: The Top 10 States by Average Net Worth

Visual Capitalist partnered with Empower to explore Americans’ average net worth and rank the top states by average net worth.

-

Personal Finance7 months ago

Mapped: The Top 10 States by Credit Card Spending

In this graphic, Visual Capitalist has partnered with Empower to rank the U.S. states by monthly credit card spending.

-

Personal Finance10 months ago

Ranked: The Top 10 States by Average Retirement Savings

The average retirement savings across all states is $498,000 per person, but how much money have the top states saved?

-

Personal Finance2 years ago

How to Reach Financial Happiness

Empower explores the roadblocks and stressors faced by Americans on the road to financial happiness.

Subscribe

Please enable JavaScript in your browser to complete this form.Join the 375,000+ subscribers who receive our daily email *Sign Up