![]()

See more visuals like this on the Voronoi app.

Use This Visualization

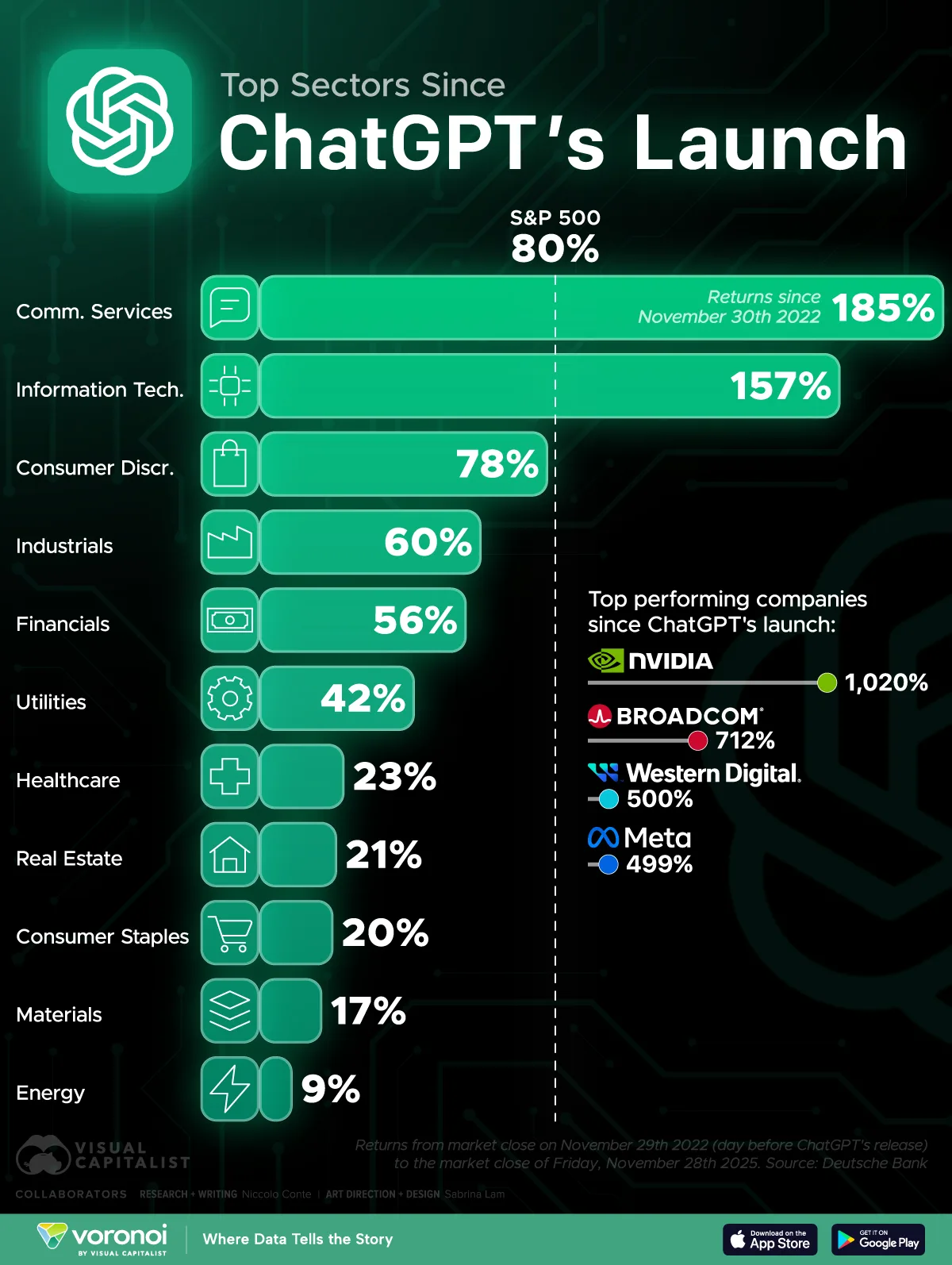

The Top-Performing Sectors Since ChatGPT Launched

See visuals like this from many other data creators on our Voronoi app. Download it for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Key Takeaways

- Tech-related sectors have dramatically outperformed the broader market since ChatGPT’s debut, driven by an AI-led investment boom.

- Nvidia, Broadcom, and other semiconductor-linked firms have seen extraordinary returns, reflecting soaring demand for AI infrastructure.

The launch of ChatGPT in late 2022 set off one of the most intense technology investment cycles in decades. Investors shifted capital toward companies and sectors positioned to benefit from AI infrastructure, cloud computing, and digital services.

This visualization highlights how each major U.S. equity sector performed from ChatGPT’s debut on November 30, 2022. Nvidia, for instance, climbed over 1,000% as demand for its AI-focused chips skyrocketed.

The data for this visualization comes from Deutsche Bank.

The AI Boom Rewired Market Leadership

Communication Services led all sectors with a 185% return, powered by Meta’s nearly fivefold increase. Information Technology followed at 157%, boosted by chipmakers and cloud providers essential to AI development.

| Rank | Sector | Returns (2022-2025) |

|---|---|---|

| 1 | Communication Services | 185% |

| 2 | Information Technology | 157% |

| 3 | Consumer Discretionary | 78% |

| 4 | Industrials | 60% |

| 5 | Financials | 56% |

| 6 | Utilities | 42% |

| 7 | Healthcare | 23% |

| 8 | Real Estate | 21% |

| 9 | Consumer Staples | 20% |

| 10 | Materials | 17% |

| 11 | Energy | 9% |

| -- | S&P 500 | 80% |

Consumer Discretionary also outperformed, helped by digital-first platforms benefiting indirectly from AI-enabled efficiency gains. Together, these results show how the AI wave extended beyond semiconductors to reshape several adjacent industries.

Nvidia and Broadcom Stand Out as Market Outliers

No companies gained more from the AI surge than semiconductor leaders.

Nvidia returned roughly 1,020%, the single largest increase among major U.S. firms. Broadcom rose over 700%, reflecting its dominance in custom AI accelerators and networking hardware. Western Digital and Meta also delivered exceptional returns, nearing or exceeding 500%.

Traditional Defensive Sectors Lagged Behind

While tech surged, defensive and rate-sensitive sectors grew at a much slower pace.

Utilities returned 42%, healthcare 23%, and consumer staples 20%. Materials hovered near the bottom due to higher interest rates and slower industrial demand. Energy posted just 9%, reflecting weaker commodity dynamics. Meanwhile, the S&P 500 returned 80% over the same period.

Learn More on the Voronoi App ![]()

If you enjoyed today’s post, check out Ranked: The Top Factors That Build AI Trust on Voronoi, the new app from Visual Capitalist.