Is America In Terminal Decline?

Authored by Raul Ilargi Meijer via The Automatic Earth blog,

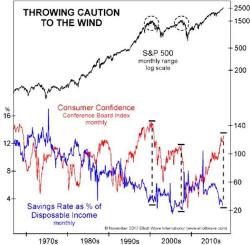

John Rubino recently posted a graph from Bob Prechter’s Elliot Wave that points to some ominous signs. It depicts the S&P 500, combined with consumer confidence and savings rate. As the accompanying video at Elliott Wave, What “Too Confident to Save” Means for Stocks, shows, when the gap between high confidence and low savings is at its widest, a market crash -often- follows.