The Angry German Press Reacts To Draghi's QExtension

Back in March, when the ECB unexpectedly announced it would begin buying corporate bonds, while the German population was rather angry, its media was furious. The best example of the fury came from Germany's Handelsblatt, which in an article titled "The dangerous game with the money of the German savers", the authors provide a metaphorical rendering of what is happening in Europe as follows:

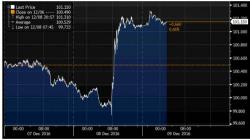

The publication also painted a caricature of the man behind Europe's monetary policy: