European Bond Yields Spike, Bank Stocks Soar, EUR Tumbles After Draghi Surprise

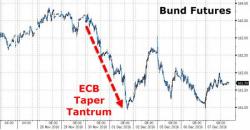

Having rallied into today's ECB meeting on hopes of geting more "whatever it takes" from Mario Draghi, his surprising tilt to the hawkish taper has sparked selling across European bond markets (pushing Bund yields to 11-month highs). EURUSD kneejerked higher on the statement but faded back quickly. Yield curves across Europe are also steepening dramatically and bank stocks are loving it.

EURUSD is sliding fast off kneejerk higher levels...

Bund yields are spiking...

Italian yields have spike to post-vote highs...