Explaining The "General Violence Of The Market's Extreme Moves"

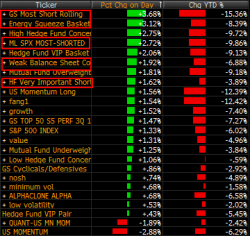

Earlier today we reported that based on various internal metrics, the market-neutral quant space is suffering one of the most violent deleveraging episodes since the infamous quant blow up in August 2007.

But what is really going on below the surface to force these dramatic moves which may not seem like much to the untrained eye, but to PMs managing 10x levered market neutral funds are earthshattering. For the answer we go to the head of US cash trading at RBC, Charlie McElligott, who has given the most succint explanation yet.