By the SRSrocco Report,

The debate continues between the SRSrocco Report and CPM Group's Jeff Christian on the fundamentals of the silver market. After my article, in which I questioned the CPM Group's exclusion of silver investment demand from their supply and demand analysis, Jeff Christian responded with a comment on my website. I am glad that Mr. Christian responded because it now allows me the opportunity to explain in more detail why I disagree with the CPM Group's analysis.

As I have mentioned before, this has nothing to do with the individual or the company, but rather what I see as faulty analysis. The whole idea of public writing is to be able to look at all sides of the story. I have the right to disagree with someone else and to explain the reasons in my articles. However, I have seen individuals in our alternative media community call names or ridicule individual's that they are in disagreement. I don't believe that is the correct way to provide open debate as it focuses on the messenger, not the message. (photo above left, courtesy of Kitco.com)

Before I get into the details on why I disagree with the CPM Group's analysis on the silver market, I wanted to share a few things. My analysis of the precious metals market has changed since I started writing articles in 2008. Early on, I didn't consider the impact of energy on the precious metals or the overall market and economy. Furthermore, I stopped putting out price forecasts several years ago because it became apparent to me that it was impossible to do so. Analysts who continue to put out specific price forecasts have been met with a great deal of frustration.

Today, I no longer believe in the fundamental theory that supply and demand forces are the leading factors in determining the price of energy, metals, commodities or most goods. Thus, the analysis that suggests supply-demand forces or investment demand impact price is flawed or is likely overstated to a large degree. Actually, I now believe that PRICE IMPACTS DEMAND, not the other way around.

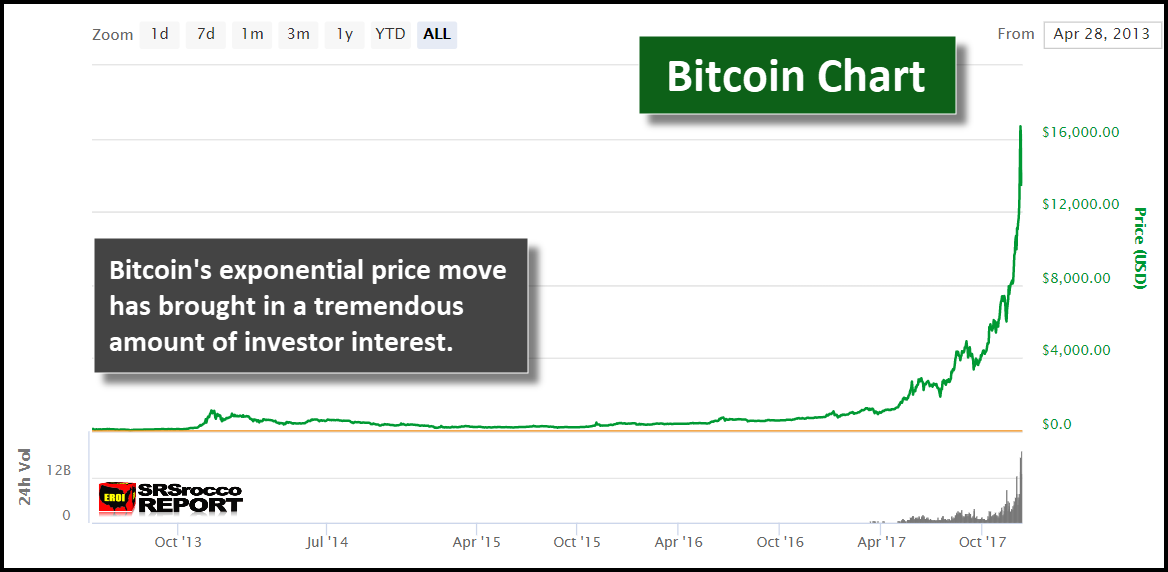

We can plainly see this taking place in the Bitcoin Market. It isn't the fundamental demand that is pushing up the price, but rather, the skyrocketing price which is causing massive speculative interest in the Bitcoin Market:

It wasn't Bitcoin's blockchain technology that drove investors mad to get involved, maybe a few initially, but the near 2,000% increase in its price since the beginning of the year. Furthermore, the insane Bitcoin price move has led to the following:

Bitcoin Mania Parabolic

Bitcoin Mania: Even Grandma Wants In on the Action

Auckland Man Sells House To Build Bitcoin Mining Rig

Bill Blain: Bitcoin Futures Could Be "A Clusterf*ck Of Monumental Proportions"

Bitcoin Has A "Whale" Problem: 1,000 Investors Control Nearly Half The Market

South Korea Bitcoin Frenzy: Everyone is Rushing to Invest in Cryptocurrencies

While it's true that increased investor demand has been a partial factor in pushing up the Bitcoin price, its likely that the parabolic move is sucking in most of the demand. I know this sounds like the old saying, "Which came first, the chicken or the egg?" But, when a small handful of investors are controlling a large percentage of the market, the little investor really isn't pushing up the price, rather... they are fuel for the deadly fire when the market collapses.

Getting back to the silver market, I would like to respond to Jeff Christian's comment from my article, THE DISINFORMATION WAR: The Attempt To Disregard Silver Investor Demand In The Market. In that article, I was responding to Mr. Christian's remarks made during an interview with Kitco news about a decade surplus in the silver market:

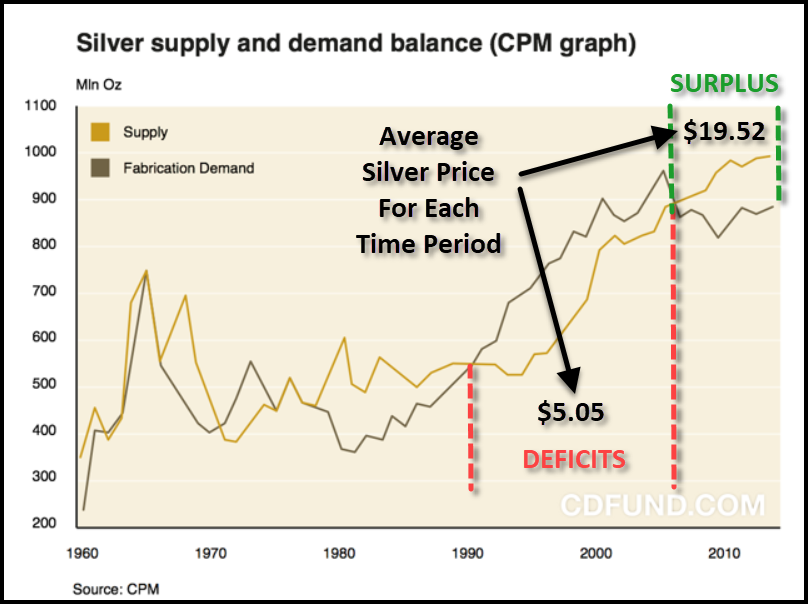

I disagreed with Jeff's statement, “that if you keep silver investment demand as an “off-budget item,” then the price matches your supply-demand analysis almost perfectly.” Here is a chart from the CPM Group on the silver market supply and demand fundamentals:

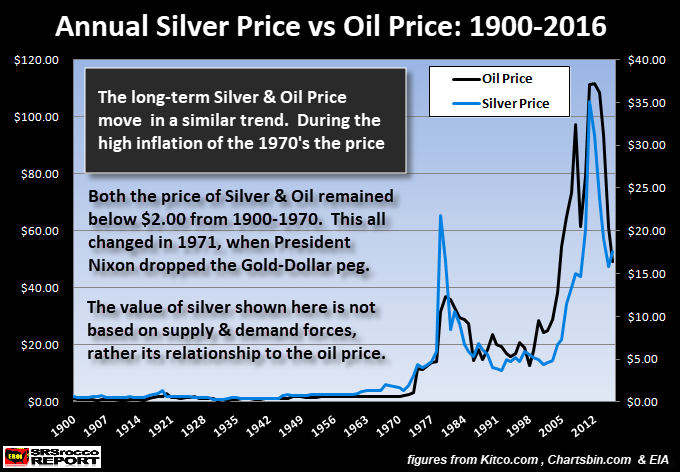

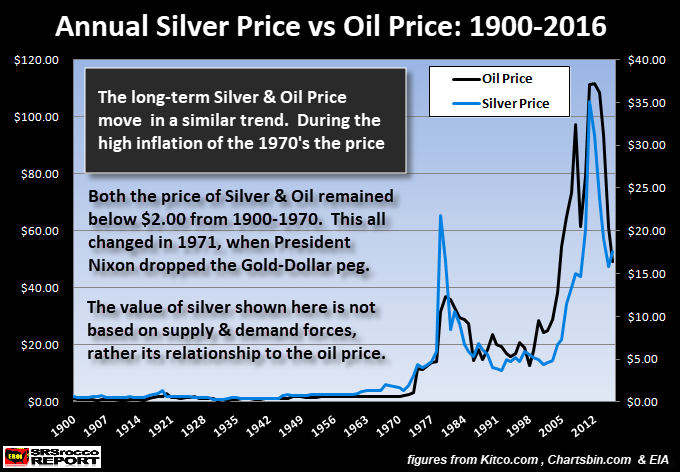

How does the CPM Group suggest that 15 years worth of deficits (according to their analysis) translates to a low $5.05 price compared to a quadrupling of the price to nearly $20 during a decade of surpluses? Yes, I would imagine that they attribute increased investment demand for the rising silver price. However, as I have mentioned several times, it has been mostly the oil price that is the overwhelming factor in determining the silver price:

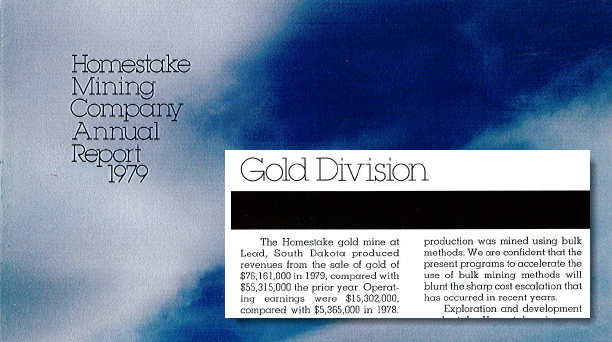

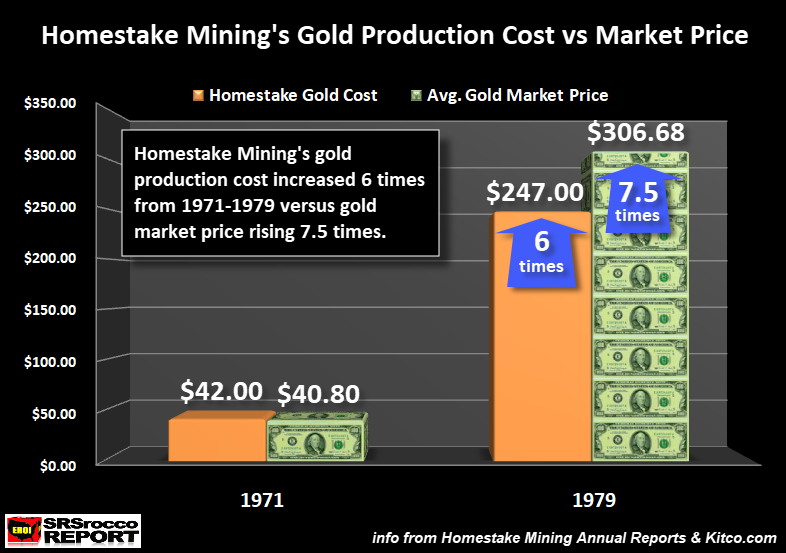

Why did the rising oil price impact the silver price? Because the cost to produce silver surged, especially during two periods (1971-1980 & 2000-2012). This was also true for gold. For example, I looked at Homestake Mining's Annual Reports (1970's) and found that their operating earnings in 1979, from their gold mine in South Dakota, were $15.3 million based on $76.1 million in total revenues:

By using this data, I calculated the estimated cost of production. Furthermore, I found that Homestake's South Dakota gold mine's operating earnings in 1971 were a negative $238,000 on total gold revenues of $21.5 million. Thus, Homestake lost money producing gold in 1971. For those readers not familiar with Homestake, they had the largest gold mine in the United States for more than half a century. Doing some simple calculations, I arrived at Homestake's gold production cost versus the gold market price:

As the oil price surged during the 1970's, it caused tremendous inflationary cost pressure on all aspects of the economy. Here, we can see that Homestake Mining's gold cost increased from $42 an ounce in 1971 to $247 an ounce in 1979. However, as Homestake Mining's gold cost grew, so did the market price. Even though the market price increased to $306.68 in 1979, it cost Homestake Mining $247 to produce each ounce. Yes, it is true Homestake enjoyed nice profits in 1979, but the notion that the gold price surged due to investment demand only totally disregards the COST PRESSURES on the gold mining industry. This is also true for silver. If gold's production cost increased significantly during the 1970's so did the cost of producing silver.

Again, this oil-energy-cost approach is missing from the CPM Group's analysis. Furthermore, the notion by industry analysts that higher gold investment demand and price would bring on more supply was not the case for Homestake. Actually, Homestake's gold production fell in half from 513,000 oz in 1971 to 246,000 oz in 1979.

Jeff Christian Responds "NEGATIVELY" To The SRSrocco Report On Proper Silver Market Analysis

Mr. Christian replied to my article where I disagreed with the CPM Group's supply and demand analysis that excluded silver investment demand. Here was the first part of his comment:

There are several very important reasons why legitimate analysts segregate investment demand from fabrication demand. One is that investment demand is distinct from fabrication demand in many important ways, including its relationship to prices. Investment demand drives prices, as anyone who studies the markets or has read ANY CPM reports for the past 40 years knows. Fabrication demand responds to prices.

If one buries investment demand in with fabrication demand, one cannot see what this prime driver of prices is doing. So, it is a separate line item in real silver market research. That allows researchers to see when the supply-demand fundamentals are tightening enough to push prices higher or loosening signaling weaker prices. More critically, it allows researchers, and real investors as opposed to always-bullish ideologues and marketers, to see when investment demand is rising sufficiently to push prices higher, or weakening in ways that suggest lower prices.

Jeff brings up a good point here, even though I disagree with their methodology. Yes, it might be a good idea to separate investment demand from fabrication demand to see how each is responding to the market, but not to determine the silver price. To rely on supply and demand fundamentals to determine price disregards the "Cost Of Production" or the "Thermodynamics" of resource depletion. According to thermodynamics, the cost to produce gold or silver will continue to increase as ore grades decline and more energy via technology is used to extract the metals.

Nowhere in the CPM Group's analysis do they discuss this. To be honest, I didn't understand the impact of energy on the precious metals or the economy until 2008. When I was first learned about silver in 2002, from reading David Morgan and Ted Bulter's analysis, I was investing in silver based only on supply and demand fundamentals. However, by continuing to dig deeper and get down to the ROOT OF THE PROBLEM, I was able to understand factors that were determining the price of gold and silver, not found in any mainstream institutional analysis.

Here is a brief outline of my changing analysis of the precious metals:

2002: Began investing in silver based on future supply and demand fundaments

2008: Wrote about Peak Silver mine supply due to the peaking of resource extraction

2013: Began to write about how the Oil Price impacted the value of Gold and Silver

2016: Started to include how "Thermodynamics," not supply and demand was another important factor in determining the price.

Since I started investing and writing about the precious metals, the most crucial EYE-OPENING factor was the understanding of how Thermodynamics impacts our way of life and economy. I owe this knowledge to Bedford Hill of the Hill's Group and Louis Arnoux. If you have not seen my interview with Louis Arnoux, I highly recommend it, Thermodynamic Oil Collapse Interview: Why The Global Economy Will Disintegrate Rapidly.

Furthermore, a group of scientists and engineers wrote a recent paper titled, Decreasing Ore Grades in Global Metallic Mining: A Theoretical Issue or a Global Reality? In that report, they did a study on how falling ore grades in metals mining impacted the amount of energy consumed in the process. Here is a chart showing the relationship between falling ore grades and increased energy consumption:

It's hard to read the chart but to simplify it, as the different metals' ore grades fall (bottom axis, moving to the left from higher to lower), the energy consumption increases (left side of the axis, goes up higher). The authors of that report wrote the following about the chart above:

The above observed trends are a reflection of the Second Law of Thermodynamics, which states that any activity performed implies the destruction of resources—degradation might be controlled and slowed down, but it cannot be avoided in the long run [28]. When the ore grade decreases in the mine, the energy required for metal extraction increases. For this reason mines with higher ore grades are exploited first, leaving the remainder for the future, hoping that technological improvements will offset those costs. But even if technology improves, the exponential character of the Second Law that can be observed in the figure clearly shows that when the ore grade approaches, the energy needed is exponentially higher. Thus, technology can improve extraction but cannot reduce the minimum energy required for the mining process as the minerals become dispersed.

Yes, some of this information is a bit complicated, but it shows that as gold and silver ore grades continue to decline, the energy consumption to extract these metals will increase. Thus, rising energy consumption and the fluctuating oil price will impact the cost to produce these metals.

CRITICAL POINT: Supply and demand forces may impact the silver price on a short-term basis, but the Thermodynamics does so over an extended period. You will not see this written in ANY INSTITUTIONAL ANALYSIS on the metals market.... ZIP, NADDA, ZILCH.

While the GFMS team at Thomson Reuters, who produce the World Gold and Silver Surveys, do not include the cost of production in their price analysis, at least they do not publically criticize other analysts for taking a different approach.

Okay, here is the last part of Mr. Christian's comment he posted on my website:

Steve, there is ignorance and stupidity. It is important to understand the difference. Ignorance means someone simply does not know what he or she is writing or talking about. It is a common weakness in U.S. society and the precious metals markets. Stupidity means that one does not have the intellectual capacity for critical thinking.

Reading your work, I can never figure out if it is one, the other, or some combination of the two that drives your writing. Clearly you are totally ignorant of CPM’s research. When you write stuff like “Investors who follow the CPM Group’s analysis on gold and silver based upon fabrication demand only, are being misinformed” you are displaying a total ignorance of four decades of our work.

Duh. You should buy our entry-level Silver Yearbook, available online at the link here.https://squareup.com/store/cpmgroup/item/cpm-gold-yearbook You also seem pretty uninformed about commodities markets, silver and gold, and other things that you regularly opine upon. That seems to be a human tragic condition, but each of us has an obligation to work to make the world better informed, starting with ourselves.

Jeff makes a few interesting remarks here. He seems to be a bit more blunt in these last few paragraphs. While I have no problem with someone being BLUNT, I have done so on occasion; you better make sure you have the GOODS TO BACK IT UP. Unfortunately, for Mr. Christian and his team at the CPM Group, they have been putting out incomplete analysis of the metals markets because they have omitted the two largest factors that determine the price of metals..... Cost of Production and Thermodynamics.

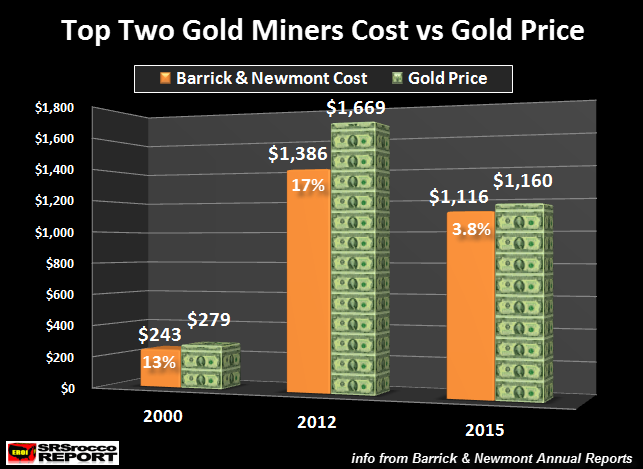

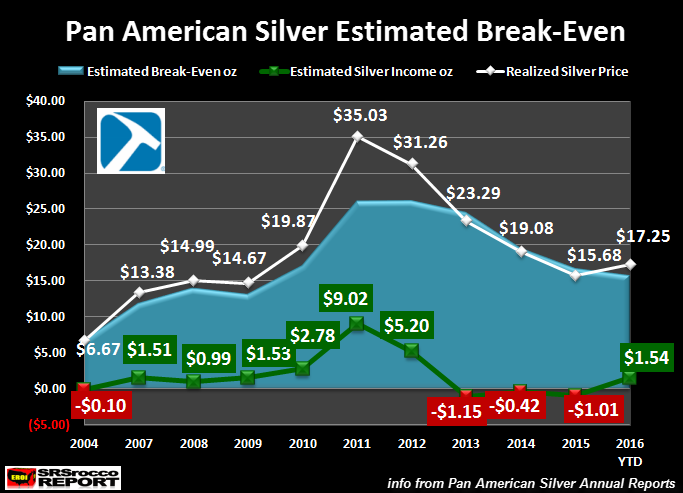

Here are two of my charts which I have posted several times as they provide the data to support the thesis that the cost of production and thermodynamics have been the leading factors in determining the price of gold and silver:

While these two charts only represent a few mining companies' cost of gold and silver production, I can assure you they are a good representation of what is taking place in the entire industry. However, if we look at what the CPM Group's 2016 Silver Yearbook says about the price of silver, we can clearly see that they only mention supply and demand forces:

Investment demand, one of the biggest influences on silver prices, meanwhile has fallen, in line with lower prices and a less worrisome economic and financial outlook on the part of many investors.

Silver and other commodities prices had risen sharply from around 2001 until 2011 or so because of several trends. One was that there had been an upward shift in the fabrication demand curve for silver. Another was a rise in investment demand. The third broad trend was that supply, at least from mining operations, was constrained and could not rapidly respond to increased demand from users and investors and the consequent increase in prices.

The CPM Group lists three reasons for the increase in silver prices from 2001 to 2011:

- upward shift in fabrication demand for silver

- rise in investment demand

- supply from the silver mining industry was constrained

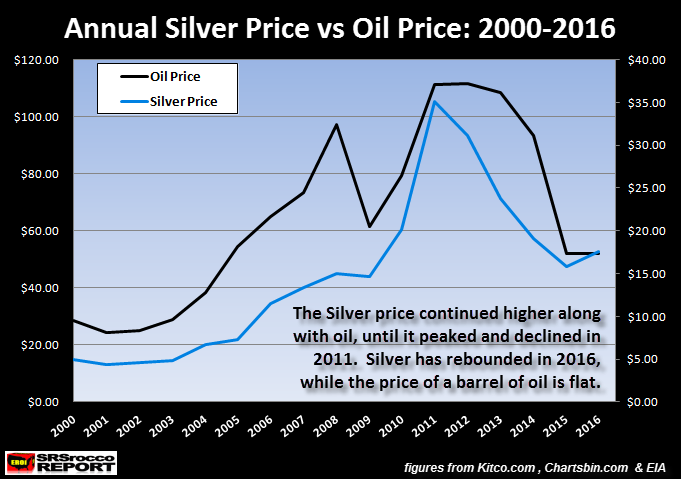

Again, we only see supply and demand forces being used to analyze price. However, if we look at the price of oil and silver since 2000, we can spot an interesting parallel trend:

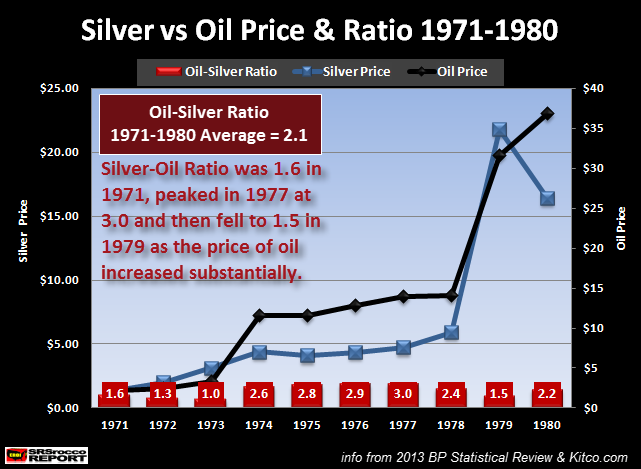

As the price of oil increased, so did the silver market price. If we go back to the 1970's, we see the same parallel trend:

It was no coincidence that the silver price shot up in 1978 along with the oil price. Of course, these trends are not exact, but we can clearly see how the oil price is impacting silver. Without oil, the world's economies would grind to a halt. So, to exclude the cost of production and thermodynamics from one's analysis of the silver price, it will turn out to be incomplete and faulty.

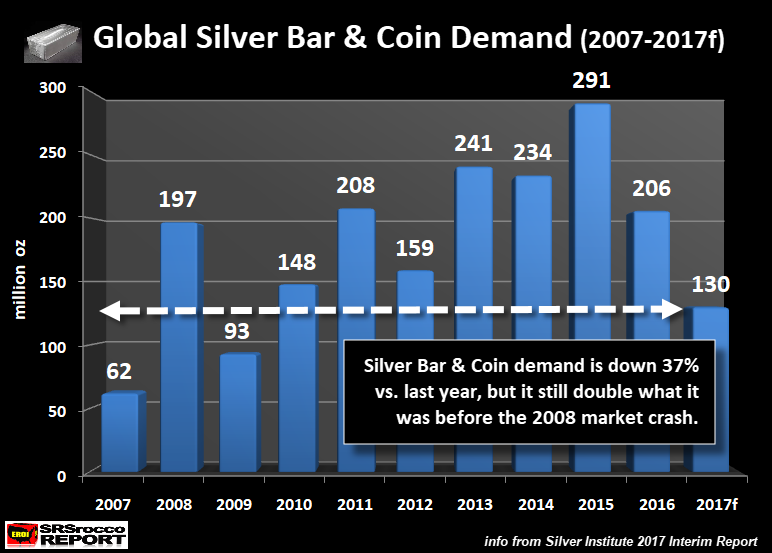

According to the CPM Group, investment demand is one of the three leading indicators of price. But, what would the CPM Group say to the record surge of silver bar and coin investment demand in 2015 as the price of silver fell 50% versus 2011?:

What is quite ironic about silver bar and coin demand in 2013, 2014 and 2015, is that it was much higher than in 2011 and 2012, even though the silver price was 30-50% less. Something just doesn't seem to jive if we go by the CPM Group's investment demand analysis of price or their supply and fabrication demand forces.

Again, the ultimate determining factor in the silver price over the past 100+ years has been the cost of energy... especially oil:

It would be interesting to see if Mr. Christian will respond to this additional energy, cost of production and thermodynamic analysis. I gather he won't because it would negatively impact the 40 years of their price analysis of the metals' markets.

Please understand I am not criticizing Mr. Christian or the analysts personally who are doing the work at the CPM Group. Rather, I am focusing on what I see as incomplete and faulty analysis due to the fact they have omitted the most important factors that determine the silver price.

Why The Silver Price Will Surge In The Future As It Disconnects From The Oil Price & Cost Of Production

Many of my readers have sent the following question, "Why would the silver price increase if you say the price of oil will trend lower?" That is an excellent question. If you have been reading my work for a while, you will understand that I believe the oil price will continue to trend lower, even though we could see price spikes, due to thermodynamics. Again, the oil price is also determined by the cost of production but also by the thermodynamics and the remaining net energy that is delivered to the market.

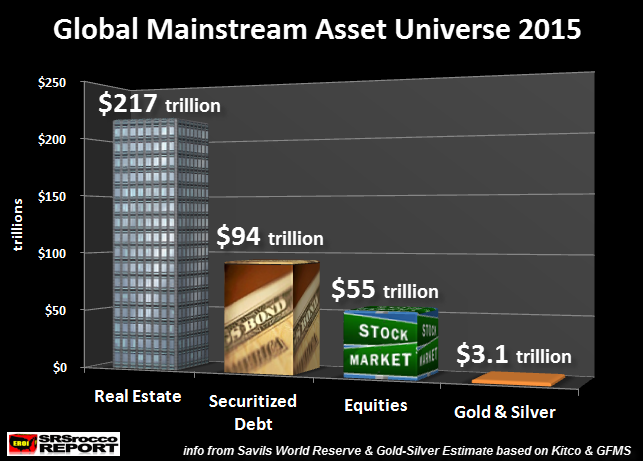

While the price of oil and thermodynamics have impacted the cost to produce silver and its market price, this will no longer be the case when global oil production heads south in earnest. Why? Because the majority of the world's assets are in STOCKS, BONDS, & REAL ESTATE:

The value of stocks, bonds, and real estate are derived from the economic principle of NET PRESENT VALUE. The values of these assets are based on future earnings. To enjoy future earnings, we must continue to burn energy and produce economic growth. Yes, growth. If we just stagnate, then the hundreds of trillions in debt and quadrillion in derivatives come crashing down.

For example, a stock price based on a PRICE TO EARNINGS RATIO must have future growth to keep the value of the stock price from falling. Thus, a STOCK PRICE gets its value from burning energy in the future. Therefore, a STOCK ASSET is an ENERGY IOU.

However, GOLD and SILVER, that you purchased and held in your possession, received its value from burning ENERGY IN THE PAST. This is a key critical difference between the precious metals and most other assets. Precious metals behave like stores of "Economic Energy," while stocks, bonds, and real estate are "Energy IOU's."

When the U.S. and global oil industry starts to disintegrate under the weight of a massive amount of debt along with the continued destruction of resource extraction by thermodynamics, investors holding on to stocks, bonds, and real estate will be wiped out. The small percentage of investors who get out of these assets and move into precious metals will push their values up to levels never thought imaginable.

That being said, it is impossible for me to provide a price forecast for either gold and silver. I believe it is impossible for anyone to provide an accurate price prediction. We can't know because we have never faced a future like anything else before.

So, when global oil production experiences CLIFF LIKE DECLINES, it will force investors to flee assets that will continue to lose their value and into precious metals that store value. This is the time when the price of silver will disconnect from its cost of production and thermodynamics. While it's hard to determine what the price will be, I can assure you that gold and silver will offer much better OPTIONS than most stocks, bonds, and real estate.

In the future, it may be that the best we can do is hold onto "Stores of Economic Energy" assets that provide us the best options over those that become liabilities and energy IOU's.

Lastly, if you haven't checked out our new PRECIOUS METALS INVESTING section or our new LOWEST COST PRECIOUS METALS STORAGE page, I highly recommend you do.

Check back for new articles and updates at the SRSrocco Report.