Just Two "Reasons" Why Gold Is Breaking Out

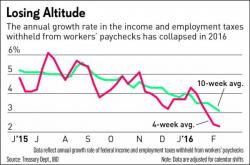

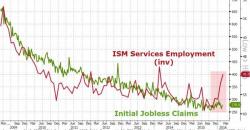

Aside from the legitimate, but largely irrelevant for the sake of this post, reasons including this morning surprisingly weak service data, in which both the ISM and the Markit PMI reports confirmed that the "malaise in manufacturing has spread to services", JPM's recommendation to sell stocks and buy gold, and the fact that slowly but surely the world is being flooded by negative rates, here are the two most actionable reasons why gold just broke out and soared to $1,260, and is fast approaching levels not seek since January 2015.