Forget Trump: The Reason For The Economic Boom Is Totally Different, And Deutsche Says It Is About To End

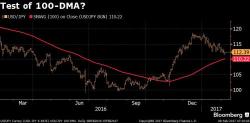

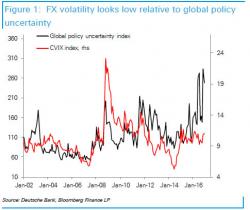

Remember the G-20 "Shanghai Accord" from February 2016, a meeting where the world's political and financial elites were rumored to sit down and unveil a plan how to boost the global economy? Well, according to a new research note out from Deutsche Bank, it was this event - together with the unprecedented credit expansion out of China that immediately followed - that catalyzed the ongoing global economic rebound, a recovery which has had nothing to do with confidence in Donald Trump policies.