Gold and Silver Hated Now, Cryptocurrencies Loved. The Debate Rages Onward, and Here’s a Solution!

by JS Kim, Founder of SmartKnowledgeU and skwealthacademy, this article was first posted at smartknowledgeu.com/blog on 1 June 2017.

by JS Kim, Founder of SmartKnowledgeU and skwealthacademy, this article was first posted at smartknowledgeu.com/blog on 1 June 2017.

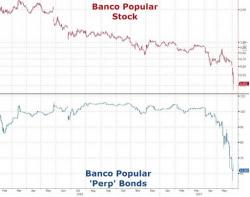

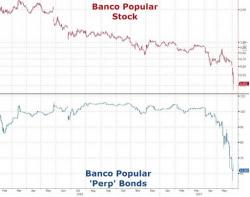

It is increasingly likely that Italy (which has been busy bailing out various insolvent banks while pretending it isn't) won't be the first nation to try out Europe's new BRRD "bail-in" insolvency directive. Instead, that honor may go to Spain where the sixth-largest bank, Banco Popular plunged the most in 28 years amid investor concerns that the bad debt-laden bank may have to liquidate as neither a buyer nor a new capital raise appear likely.

Back in 2014, a scandal erupted when media reports confirmed what many had previously speculated about China's banking system: namely that much of China's staggering loan issuance had been built (literally) upon air and that billions (or trillions) in loan collateral had been "rehypothecated" between two, three or many more debtors - or never even existed - forcing banks to accept that they would never recover much if any of the pledged collateral - in most cases various commodities - if the economy were to suffer a hard-landing resulting in mass defaults.

Even as attention has turned once again to Italy as the next possible source of European financial contagion, Spain's sixth largest bank has found itself in freefall over the past few days as concerns grow that the bank may be liquidated unless a last-minute buyer, or source of capital, emerges.

Whereas most bank clients accepted a bail-in as one of the risks associated with depositing cash on a bank account, Italy doesn’t seem to be too sure about forcing its banks to do so.

We all know the never-ending issues related to Banca Monte Dei Paschi, but that bank wasn’t Italy’s only problem. Two smaller banks, Banco Popolare di Vicenza and Vento Banca also need to be rescued. Although these banks are definitely smaller than Monte Paschi, and wouldn’t have a huge impact on the international banking system, it definitely is an issue which has to be solved.