Michael Snyder Rages "The Federal Reserve Must Go"

Authored by Michael Snyder via The Economic Collapse blog,

Authored by Michael Snyder via The Economic Collapse blog,

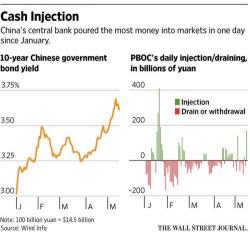

Is China's push to deleverage its financial system over?

Step aside Citi US Economic Surprise Index, which after a "surprising" streak of negative economic data, recently crashed to the lowest level since October 2016...

... and make way for Morgan Stanley's ARIA, a monthly US macro indicator based on data collected through primary research on key US sectors (consumer, autos, housing, employment, and business investment).

Authored by Simon Black via SovereignMan.com,

Sometimes I wonder why most of the giant mega-banks are based in New York.

They should be here in Las Vegas, the gambling capital of the world. Because that’s precisely what they’re doing with your money.

Actually it’s not even your money.

From a legal perspective, every single penny you deposit at the bank becomes THEIR money. You’re nothing more than an unsecured creditor of the bank.

Amid Poloz-described "unsustainable prices" in various cities, and just days after the collapse of Canadian mortgage lender Home Capital Group and our discussion of the dire state of Canadian savers (and their record household debt), Moodys has cut the ratings on six of Canada's largest banks because of "ongoing concerns that expanding levels of private-sector debt could weaken asset quality in the future."