Money Under Fire

Submitted by Chris Martenson via PeakProsperity.com,

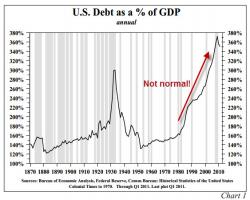

One serious predicament we face is that the current leaders in the halls of monetary and political power do not appear to understand the dimensions of our situation. The mind-boggling part about it is that the situation is easy to understand.

Our collective predicament is simply this: Nothing can grow forever.