ECB Stuns Markets, Announces Tapering Of Bond Purchases To €60 Billion

That Reuters trial balloon was right.

That Reuters trial balloon was right.

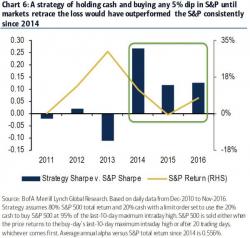

A strategy of holding cash and buying any 5% dip in S&P until markets retrace the loss has outperformed the S&P consistently since 2014, but as BofAML warns, the changes in inflation market dynamics post-Trump may "handcuff" The Fed and pull a key support out of the market that helped create the "buy the dip" trade.

Submitted by Nick Giambruno via InternationalMan.com,

The next domino has fallen...

I recently spent several weeks in Italy, taking the pulse of the country. The Italian referendum on December 4 turned out exactly how I predicted it would.

The “No” vote won in a landslide, with 59% of the vote versus 41% for “Yes,” with a 70% turnout.

The pro-EU Prime Minister promptly announced his resignation after the crushing defeat.

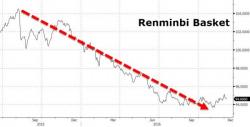

It appears that devaluing your currency against by over 10% in a year against your major trading partners does have some affect (albeit delayed). China Exports (in Yuan terms) grew at 5.9% in November (the fastest growth since March) (well ahead of the expected 1% decline). Imports, however, also soared (by 13%) in Yuan terms. However, in USD terms, Imports rose by the most since Sept 2014 (and exports managed a small rise) as China's trade surplus slipped and missed expectations. Offshore Yuan is strengthening modestly on the print.

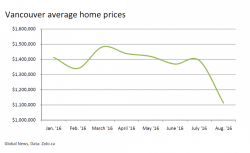

Back in August we noted that the Vancouver housing market was doomed after the implementation of a 15% property tax on foreign buyers targeting the massive influx of Chinese money driving real estate prices to astronomical levels. Sure enough, within a matter of weeks home prices had plunged and so had the volume of residential real estate transactions (see "As The Vancouver Housing Market Implodes, The "Smart Money" Is Rushing To Get Out Now").