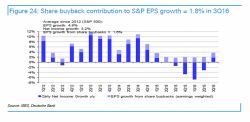

The Difference Between GAAP And Non-GAAP Q3 Earnings For The Dow Jones Was 25%

As of today, 95% of the companies in the S&P 500 have reported earnings for Q3 2016. 72% of the companies have reported earnings above the mean estimate and 55%of S&P 500 companies have reported sales above the mean estimate. More importantly, however, according to FactSet in Q3 the earnings recession officially ended after five consecutive quarters of EPS declines: for Q3 2016, the blended earnings growth rate for the S&P 500 is 3.0%. The third quarter marks the first time the index has seen year-over-year growth in earnings since Q1 2015 (0.5%).