Chevron is the Poster Child for an Overpriced Market (Video)

By EconMatters

By EconMatters

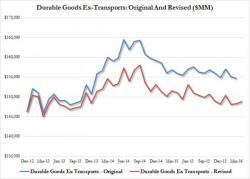

Just one week after the US Department of Commerce quietly slashed historical US capex spending by billions of dollars following a major data revision...

... it was time for another major revision to a series that is nearer and dearer to most Americans' hearts, namely Disposable Personal Income.

As we noted earlier, today's Personal Income and Spending report revealed that personal spending in April surged by 1%, or the most since August 2009 driven in part by a major jump on energy goods and services.

This is the 17th month in a row of contraction for Dallas Fed's manufacturing survey as the headline print plunged to -20.8 from -13.9 (missing expectations of a hopeful bounce to -8.0 by 6 standard deviations). Despite the unequivocally good rebound in oil prices, sentiment in Dallas remains dismal with new orders crashing as even 'hope' has now given way to realism as the 6-month outlook tumbles back into negative territory.

This is a 6 standard deviation miss...

The Conference Board's consumer confidence measure has hovered around the 95 level for the last 6 months (as gas prices dipped and ripped, as stock prices dipped and ripped, and as political chaos reigned). This 'stability' is in stark contrast to other surveys of confidence such as Bloomberg's and Gallup's which are both at multi-month lows... until today. Consumer Confidence plunged to 92.6 (missing expectations of 96.1 by the most since November).

Having wavered around the magical '50' level for much of the last year, bouncing off December plunge lows, Chicago PMI printed below expectations of 50.5 at a contractionary 49.3 - the 6th month of contraction in the last 12 months. With weakness in new orders (lowest since Dec 2015) and production (both back into contraction), MNI notes that on the heels of April's decline, the latest results show activity stumbling in the second quarter, following only moderate growth in Q1.

The 8th month of contraction in th elast 14..