Global Financial Crisis Coming – Japan Warns of “Lehman-Scale” Crisis At G7

Global Financial Crisis Coming – Japan Warns of “Lehman-Scale” Crisis At G7

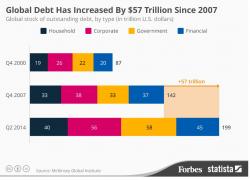

Japanese Prime Minister Shinzo Abe warned his Group of Seven counterparts on Friday that the world may on the brink of a global financial crisis on the scale of Lehman Brothers.