Stocks, Bonds Slide As Hawkish Yellen Sends July Rate-Hike Odds To Record Highs

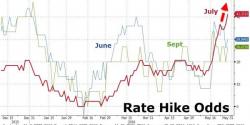

Following Yellen's uncharacteristicaly hawkish tone, the odds of a July rate-hike have shot higher - now higher than June or September have ever been - to record highs. This has sent short-term bond yields higher, the yield curve dramatically flatter, stocks lower, and gold down...

July Rate hike odds soar... (note these are the odds of a rate hike in that month - which suggests The Fed will be "one more and done")

and the reaction in asset markets as bonds close early and correelations break down...