Egypt’s Economy, More Trouble Ahead

Authored by Steve H. Hanke of the Johns Hopkins University. Follow him on Twitter @Steve_Hanke.

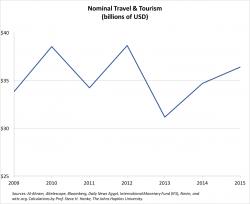

Early last Thursday, EgyptAir 804 disappeared over the Mediterranean, becoming the second civilian airliner in less than seven months to go down while flying either to or from Egypt. Both this incident and Metrojet 9268’s disaster of last October were terrorist acts. Tourism to Egypt, a major earner of foreign exchange, has already been flat for years and will suffer even further from these airline disasters.