Crude Spikes Above $49 After Biggest Inventory Draw Since 2015

Following last week's surprise draw (from the DOE data), API reported a huge 5.14mm draw (against expectations of a 2mm barrel draw) - the biggest since Dec 2015. Bear in mind that last week API reported a large build only to se a major draw in DOE data so perhaps this is catch down from the Canada interruption.

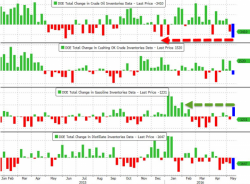

API

- Crude -5.137mm (-2mm exp)

- Cushing -189k (-400k exp)

- Gasoline +3.06mm (-1.5mm)

- Distillates -2.92mm (-750k exp)

This is the biggest inventory draw since Dec 18th...