Brexit Scaremongering Taken To New Level With Threat Of "Year Long Recession"

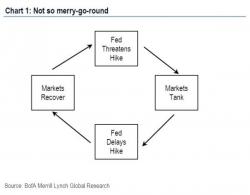

The last few weeks have seen 'Project Fear' taken to all new levels by the UK establishment as doom-mongering over a possible Brexit conjure images of post-apocalyptic movies. UK PM Cameron and Chanceller Osborne's latest op-ed tirade warns of 800,000 jobs lost and an "immediate year-long recession" if the Brits exercise their democratic right to vote for sovereignty over tyranny. Judging from the polls, which show Brexit odds tumbling, the fear-mongery is working, however, the markets disagree as forward volatility measures near 2016 highs.