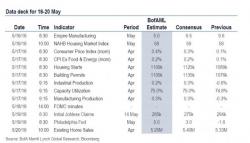

Key US Macro Events In The Coming Week

After last week's key event, the retail sales number, which the market discounted as being too unrealistic (and overly seasonally adjusted) after printing at a 13 month high and attempting to refute the reality observed by countless retailers, this week has a quiet start today with no data of note due out of Europe and just Empire manufacturing (which moments ago missed badly) and the NAHB housing market index of note in the US session this morning.