What Recovery? Poultry Workers Denied Bathroom Breaks, Wear Diapers On The Job

Submitted by Mike Krieger via Liberty Blitzkrieg blog,

Submitted by Mike Krieger via Liberty Blitzkrieg blog,

After three consecutive weeks of seemingly relentless bad news for Apple, moments ago the stock jumped by $2 dollars, rising from $90.5 to over $92.50. There was some confusion as to why the jump and then it was revealed that none other than that "other" billionaire, Warren Buffett, has decided to start building a stake in the world's biggest cell phone company to the tune of 9.8 million shares or about $1.07 billion as of March 31.

Just around 2:14am local time (2am EDT), Asian traders were surprised to observe in the Chinese market something which until recently had been a purely development market phenomenon: a flash crash. A sudden plunge by Chinese stocks in Hong Kong had traders scrambling to find a trigger for the slump that coincided with a surge in futures volumes Bloomberg writes.

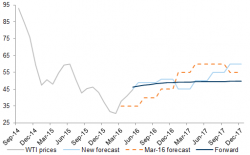

The main risk over the weekend was that markets, which have now dropped for three consecutive weeks the longest negative streak since January, would focus their attention on the latest batch of negative Chinese economic news released over the weekend, which missed expectations across the board, most prominently in Retail Sales (10.1% vs. Exp. 10.6%, down from 10.5%) and Industrial Production (6.0% vs. Exp. 6.5% down from 6.8%), and following Friday's disappointing new credit loan data, would sell off as the Chinese slowdown once again becomes a dominant concern.