Pure Troika Idiocy - The Greek Debt Slavery Regime Through 2059

Submitted by Michael Shedlock via MishTalk.com,

Irreconcilable Positions

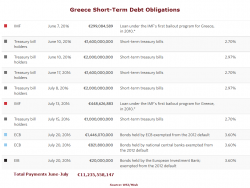

Greece owes the Troika over €11 billion in bailout repayments through the end of July. Greece is unable make those payments unless the Troika releases the funds.

Position 1: “We need a big debt restructuring, no more kicking the can,” says Greece’s Minister of State.