Markit, ISM Paint Conflicting Pictures Of US Service Economy; Market Focuses On The More Bullish One

One again it was a "good cop, bad cop" combination of the Markit and ISM service surveys.

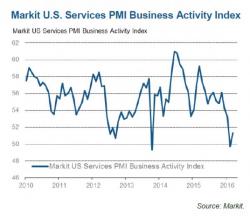

First, it was Markit, which printed at the just barely expansionary Final March print 51.3, up from the preliminary 51.0, but the internals continued to deteriorate. As the chart below shows, and as the commentary confirms, the US service sector is barely hanging on by a thread.

Some of the highlights: