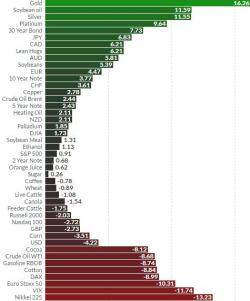

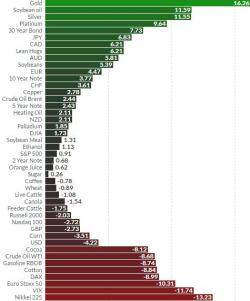

Gold Prices Rise 16% In Q1 – Best Quarter In 30 Years

Gold Prices Rise 16% In Q1 – Best Quarter In 30 Years

Gold Prices Rise 16% In Q1 – Best Quarter In 30 Years

In mid-February, we warned of the looming carnage for equity market-neutral funds, and sure enough, as Bloomberg reports, one of the most popular (and successful) hedge fund trades - playing the difference between high- and low-momentum stocks - crashed by the most since 2009 in Q1. After 6 years of almost unstoppable gains, equity market-neutral funds suffered their biggest losses since 2012 - comparable to the 2007 quant crisis devastation - as weak momo stocks massively outpeformed crushing the hedgies' models.

In the past few months, the Bureau of Labor Statistics has gone out of its way to show that U.S. worker compensation is finally rising. There is one problem with that: while that may be true on an hourly basis...

... on a weekly basis, the picture is vastly different. What is happening is that weekly wage growth have gone nowhere in years, but because the average hours worked per week has declined and today hit a 2 year low of 34.4, it translates into more money per hour worked.

Via InternationalMan.com,

(This is Doug Casey’s foreword to Casey Research’s Handbook for Surviving the Coming Financial Crisis.)

Right now, we are exiting the eye of the giant financial hurricane that we entered in 2007, and we’re going into its trailing edge.

It’s going to be much more severe, different, and longer lasting than what we saw in 2008 and 2009.

Submitted by Peter Schiff via Euro Pacific Capital,

It may be almost impossible to underestimate the gullibility of professional Fed watchers. At least Lucy van Pelt needed to place an actual football on the ground to fool poor Charlie Brown. But in today’s high stakes game of Federal Reserve mind reading, the Fed doesn’t even have to make a halfway convincing bluff to make the markets look foolish.