This Is What Central Bank Failure Looks Like (Part 3)

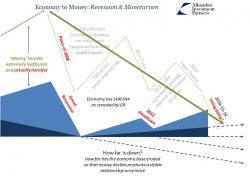

First, it was The BoJ's utter collapse from omnipotence to impotence. Then came the collapse of The Fed's credibility in the short-term. And now, in the most egregious example of total central bank failure - the 'market' has priced out any chance of a rate hike through 2018... and in fact, there is now a greater chance of a rate-cut (than rate-hike) into 2017.

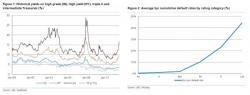

Based on the Eurodollar market...

And while some hoped that Janet would clear it all up in 2 days of testimony, she just made it worse: