Ben Bernanke: Buy One Suit, Get Three Free

Ben Bernanke is no longer the Fed's chairman, but this article is even more relevant today then it was when I wrote it in August 2013.

Ben Bernanke: Buy One Suit, Get Three Free

By Vitaliy Katsenelson, CFA

Ben Bernanke is no longer the Fed's chairman, but this article is even more relevant today then it was when I wrote it in August 2013.

Ben Bernanke: Buy One Suit, Get Three Free

By Vitaliy Katsenelson, CFA

Submitted by Mike Krieger via Liberty Blitzkrieg blog,

While the Case-Shiller home price index rose modestly MoM (+0.87%), it continues to disappoint expectations with the 7th consecutive miss in a row. Notably, unadjusted the monthly rise in prices was just 0.1%. Year-over-year gains of 5.8% for the top 20 cities is the fastest price appreciation since July 2014 - thanks once again to seasonal adjustments.

7th miss in a row for the non-seasonally-adjusted data...

And the "improvement" in the headline data is all seasonal-adjustments:

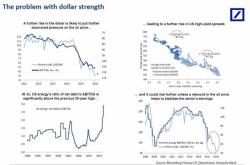

In what is the first official warning to a central bank to no longer do what has been done so far for seven years, earlier today Deutsche Bank came out with a startling presentation addressed to Mario Draghi, warning him explicitly that any more QE will not only not help stocks (and certainly not DB stock which continues to plumb post-crisis lows on fears it is overexposed to the commodity crunch and potentially such names as Glencore and various other commodity traders), but will actually push equities lower.

George Soros may have broken the BOE and may well have been at least partially to blame for the Asian Financial Crisis, but he will not win an FX battle with the PBoC.

Or at least that’s Beijing’s message to the billionaire, as conveyed via a characteristically hilarious “op-ed” in the People’s Daily entitled “Declaring war on China’s currency? Ha ha”