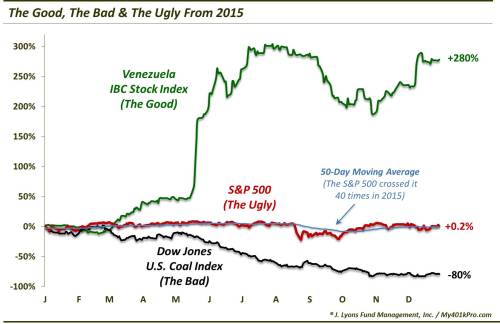

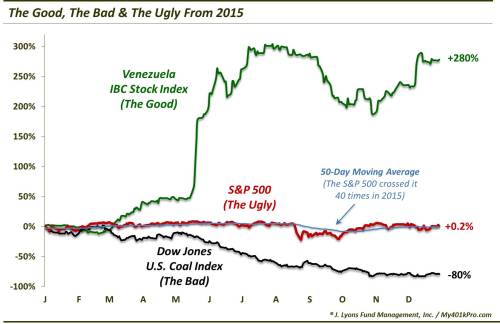

The Good, The Bad & The Ugly From 2015

Via Dana Lyons' Tumblr,

A brief sampling of the best, worst and toughest financial markets of 2015.

Via Dana Lyons' Tumblr,

A brief sampling of the best, worst and toughest financial markets of 2015.

Submitted by Charles Hugh-Smith of OfTwoMinds blog,

Any serious reform has to start with the dissolution of the existing political parties and the Federal Reserve. Anything less is self-serving, pandering fantasy.

Well-paid econo-pundit Joseph Stiglitz has a new book that repeats the usual pandering fantasy that "reform" can fix what's broken with the U.S. economy: Rewriting the Rules of the American Economy: An Agenda for Growth and Shared Prosperity.

After melting up to pre-API levels this morning, crude prices are falling back (and therefore so are stocks) as Baker Hughes reports another weekly decline in rig count. After surging by 17 three weeks ago, the 2 rig decline in oil rigs in America continues to track the lagged crude oil price.

Rig count continues decline...

Seems like the algos have run out of stops to run...

Two days ago we said that the explanation provided by China's latest corporate fraud, China Animal Healthcare, for "losing" its books, may well be the greatest official reason provided by a management team for cooking the books.

Submitted by Alexander Grover

Darkness is Upon Us: Norway’s Key Figures Going Into 2016