Top Crypto-Mining Executive Explains Why "We're Hoarding The Coins"

Authored by Mac Slavo via SHTFplan.com,

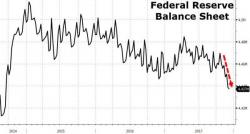

If the price action in crypto currencies over the last several months has proven anything, it’s that the blockchain has gone fully mainstream with global investors, major financial institutions and governments showing significant interest in the space. While a number of blockchain projects are moving onto the stage, the primary focus for investors has been Bitcoin, which has seen an increase of over 1,600% in 2017. And according to Frank Holmes, there is much more to come.