Financial Instability & The Fed

Submitted by Martin Armstrong via ArmstrongEconomics.com,

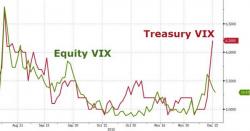

The argument that the Fed should do nothing - for it will be harder to correct a rate rise than to do nothing - because there is no bubble anywhere, demonstrates that we have the most serious BUBBLE in history. Retail participation in markets is still off by 50% from 2007 highs. People have invested in fixed income and now there is a crisis is fixed income hedge funds.