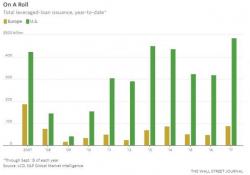

Levered Loan Volumes Soar Past 2007 Levels As "Cov-Lite" Deals Surge

If a surge in covenant-lite levered loans is any indication that debt and equity markets are nearing the final stages of their bubbly ascent, then perhaps now is a good time for investors to take their profits and run. As the Wall Street Journal points out this morning, levered loans volumes in the U.S. are once again surging, eclipsing even 2007 levels, despite the complete implosion of bricks-and-mortar retailers and continued warnings that "the market is getting frothy."