How Banks Hurt The Real Economy - FDIC's Hoenig To Senate

Authored by Wolf Richter via WolfStreet.com,

"The real economy has little to gain, and much to lose.”

Authored by Wolf Richter via WolfStreet.com,

"The real economy has little to gain, and much to lose.”

Until mid 2017, it appeared that nothing could stop the Toronto home price juggernaut:

And yet, In early May we wrote that "The Toronto Housing Market Is About To Collapse", when we showed the flood of new home listings that had hit the market the market, coupled with an extreme lack of affordability, which as we said "means homes will be unattainable to all but the oligarchs seeking safe-haven for their 'hard'-hidden gains, prices will have to adjust rather rapidly."

Authored by Tho Bishop via The Mises Institute,

When Janet Yellen testified before the House Financial Services Committee last month, she faced grilling on a topic that hasn’t received enough mainstream attention: the interest being paid on excess reserves at the Fed. While the topic has come up occasionally since the program began in 2008, it is worth noting that Yellen was pushed by both Jeb Hensarling, the committee chairman, and Andy Barr, the chairman of the Monetary Policy Subcommittee.

From Art Cashin of UBS:

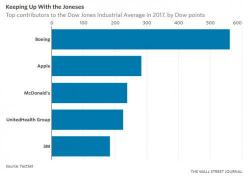

We've noted over the last two weeks that the Dow Industrials have been diverging from most other indices and particularly the Dow Transports. An important part of the divergence has been the relative narrowness of the rally in the Dow. In today's WSJ, Justin Lahart took note of the narrowness:

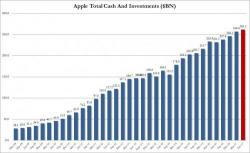

Every quarter, Apple manages to impress with its gargantuan cash hoard, which in Q2 rose to $262 billion (which however is $153 billion net of debt), a new all time high as shown in the chart below.