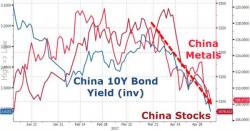

China Commodity Crash Accelerates As Traders "Forced To Destock"

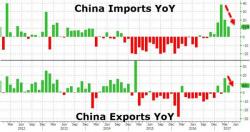

"Iron ore doesn't have good fundamentals," warns one analyst as while the crackdown on leverage in Chinese capital markets (which has tightened liquidity everywhere) is the immediate catalyst, "supply-side pressure is huge as ever, and mills are still seeking to draw down inventories."