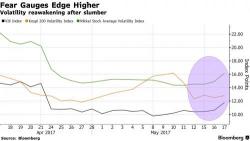

Trumpquake: Futures Wipe Out Month's Gains In One Session, VIX Spikes

A risk-off mood dominated the overnight session amid growing concern over the turmoil engulfing the Trump administration, as fresh allegations add to deepening political scandals in Washington, the latest coming from Tuesday's NYT report citing former FBI director Comey’s memo which raises possibility of obstruction of justice, an impeachable offense. The dollar, already in retreat after a report that the U.S.