"Few Are Yet Willing To Admit The Harsh Reality..."

Excerpted from Doug Noland's Credit Bubble Bulletin,

Excerpted from Doug Noland's Credit Bubble Bulletin,

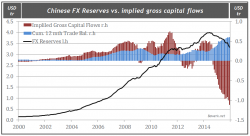

As we previewed on Thursday, the biggest event of the week, and perhaps of the month, was not Friday's nonfarm payroll report, but the January update of China's FX reserves, which the PBOC released last night. The number came out at $3.2309 trillion, down $99.5 billion from the prior month, and $8 billion less than the December outflow of $107.6 billion.

No it is not, a slowing economy crippled by 346% in debt/GDP; it's not the artificially high exchange rate (which was pegged to a dollar when it was plunging during QE1-3 and is now soaring) yet which China can't aggressively lower either as that would mean a disorderly flight of capital from the mainland; it's not the feedback loop of plunging commodity prices and highly levered domestic corporation which can not pay their annual interest expense payments; it's not the recently burst housing bubble; nor is it the burst stock market bubble which recently popped, or the bond bubble which is

Submitted by Alasdair Macleod via GoldMoney.com,

Last Sunday (31 January) Zero Hedge ran an article drawing attention to the big names in the hedge fund community who are betting heavily that the yuan will suffer a major devaluation any time between the next few months and perhaps the next three years.

The impression given is that this view is universal, almost to the exclusion of any other.

Submitted by Eugen Bohm-Bawerk via Bawerk.net,