The Chart Of Doom: When Private Credit Stops Expanding...

Submitted by Charles Hugh-Smith of OffTwoMinds blog,

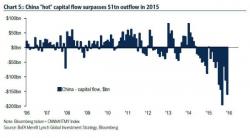

Once private credit rolls over in China and the U.S., the global recession will start its rapid slide down the Seneca Cliff.

Few question the importance of private credit in the global economy. When households and businesses are borrowing to expand production and buy homes, vehicles, etc., the economy expands smartly.