China Trade Data Beats As Crude Demand Surges (Ahead Of Maintenance)

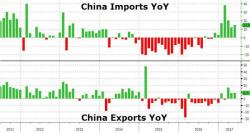

Thanks to a 13% surge in crude imports (as refiners prepare for maintenance season), China's trade surplus hit its highest since Jan (though -4% YoY). Imports (+14.8% YoY) and Exports (+8.7% YoY) both beat expectations.

China’s overseas shipments accelerated in May from a year earlier, as Bloomberg suggests global demand shows signs of picking up.