Stocks Set For New All-Time Highs, Nikkei Rises Above 20,000, Oil Slides

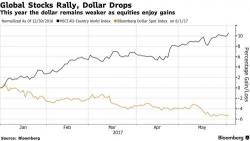

The day after Trump pulled out of the Paris Climate Accord, stocks are set for new all time highs with S&P futures up 0.2%, boosted by green markets across Europe and Asia, where the Nikkei rose above 20,000 for the first time since 2015. World stocks are set for new record highs, having already gained 11% so far this year, ahead of today's US nonfarm payrolls which are expected to increase by 185,000 jobs after surging 211,000 in April.