Buried Beneath The Headlines...

Authored by Kevin Muir via The Macro Tourist blog,

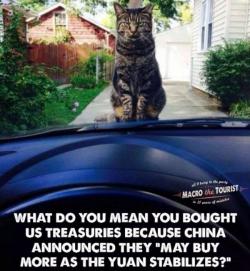

This morning’s big news is the Chinese announcement they would they would buy more US Treasuries as the Yuan stabilizes. From Bloomberg:

China is prepared to increase its holdings of U.S. Treasuries under the right circumstances, as officials judge the assets are becoming more attractive than other sovereign debt and as the yuan stabilizes, according to people familiar with the matter. Treasuries rose, driving yields to the lowest since November.