The Fed's Dependence On The Consumer Will Backfire

Via C.Jay Engel of The Mises Institute,

The story is that it is consumers that are going "to push the economy to grow more than 2 percent this year." That's Dallas Fed President Robert Kaplan's recently expressed view. It's the old fallacy of spending — rather than saving — our way into growth.

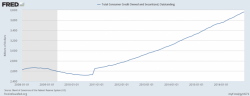

It's remarkable that no one talks about the fact that the economy since 2008 was built on little but cheap debt, and therefore depends on the continued flow of such debt.