The Four Scariest Charts For Energy Investors

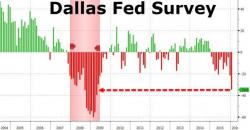

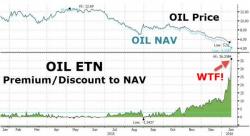

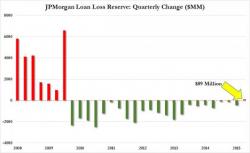

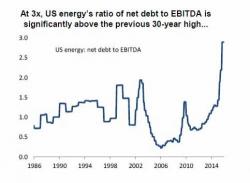

Much has been said, and many charts shown demonstrating how collapsing oil prices equate with a recessionary (and, according to at least one Dallas Fed respondent, "depressionary") hit for the US energy space and manufacturing sector first, and subsequently, contagion for US banks various other investors in the US shale space, and ultimately the broader economy.

Perhaps too much.

So in an attempt to simply some of the confusion, here are just four charts which, in our opinion, are among the scariest for energy investors.