Global Stocks Rise On Strong Economic Data, Dollar Set To End Streak Of Monthly Declines

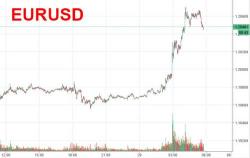

It's groundhog day as S&P futures, European and Asian shares all rise overnight, while the dollar is set to .

It's groundhog day as S&P futures, European and Asian shares all rise overnight, while the dollar is set to .

For today's stock market recap, see yesterday!

In a comedic case of deja vu, somebody flicked the "DUMP VIX, BUY NASDAQ" swicth at exactly the moment US equity markets opened...

If NKorea doesn't launch a rocket tonight, stocks may sell off tomorrow

— zerohedge (@zerohedge) August 29, 2017

Blink and you missed it...

The message from the plunge/panic protection team is clear...

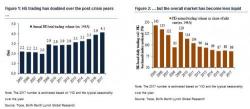

Instead of finding new and creative ways of BTFD, overnight the BofA credit team did something so few finance professionals bother with these days: they looked at fundamental data to reach a conclusion that is independent of how much AAPL stock the SNB will have to buy to send the Dow Jones green. Specifically, the bank looked at the liquidity situation in the bond market (specifically the IG space), and found that while for the time being there is little to worry about, once the central bank put melts away, that's when the real test will take place.

“Financial markets think the only realistic option for the U.S. and North Korea will be to sit down and talk at some point because other options are too costly for everyone involved. But no one can rule out the risk of accidents. Markets think the chicken game will continue for now and North Korea will remain a risk.”

- Masayoshi Kichikawa, chief strategist at Sumitomo Mitsui.