FX Week Ahead - Fast Money Algos Stretch The Limits Again, Time For Redress

Submitted by Shant Movsesian and Rajan Dhall MSTA from fxdaily.co.uk

FX Week Ahead - Fast money algos stretch the limits again, time for redress

Submitted by Shant Movsesian and Rajan Dhall MSTA from fxdaily.co.uk

FX Week Ahead - Fast money algos stretch the limits again, time for redress

Authored by Craig Wilson via The Daily Reckoning,

Jim Rickards joined Alex Stanczyk at the Physical Gold Fund to discuss current destabilizing factors that could drastically impact investors. During the first part of their conversation the economic expert delved into gold positioning for the future, the expanding threats from North Korea and liquidity in global markets.

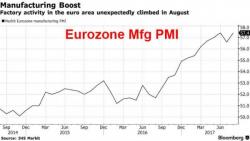

Global markets are stuck in a holding pattern with S&P futures up modestly after fluctuating overnight, as European and Asian shares rise with oil while the dollar has dipped lower ahead of the biggest central bank event of the year: the Fed's Jackson Hole symposium where Janet Yellen and Mario Draghi will speak at 10am and 3pm ET, respectively. Meanwhile, world stocks drifted toward their best week in six on Friday, as a near three-year high in emerging markets shares and a roaring rally in industrial metals bolstered the year’s global bull run.

Yesterday, when stocks surged at the market open following Politico's report that Trump is unexpectedly "making strides" on tax reform, we warned that "it can all be wiped away as soon as tonight, when Trump will deliver a speech to his "base", in which he may promptly burn any of the goodwill he created with capital markets following his far more conventional Afghanistan speech last night."Well, that's precisely what happened, because on Tuesday night, in another fiery campaign rally, Trump fiercely defended his response to violence in Charlottesville, made passing remarks from a

Seriously...

Thanks to The White House saying something de minimus about Tax Reform progress (and a little help from Boeing after Trump's warmongery), Nasdaq was the day's best-performer as The Dow had its best day in 4 months...