Get Out Now: SocGen Predicts Market Crash, Bear Market For The S&P

While the charade of sellside analysts releasing optimistic, and in the case of Barclays and Goldman "rationally exuberant"previews of the year ahead...

While the charade of sellside analysts releasing optimistic, and in the case of Barclays and Goldman "rationally exuberant"previews of the year ahead...

Be it a sudden surge in the effectiveness of Russia's international espionage and cyber warfare operations or a mere figment of the imaginations of a frightening group of politicians in the West who fear they're slowly losing control over the masses in their respective countries, one thing is certain, Russia is increasingly being blamed for some very serious "meddling" in foreign affairs.

Authored by David Stockman via Contra Corner blog,

You could almost understand the irrational exuberance of 1999-2000. That's because everything was seemingly coming up roses, meaning that cap rates arguably had rational room to rise.

But eventually the mania lost all touch with reality; it succumbed to an upwelling of madness that at length made even Alan Greenspan look like a complete fool, as we document below.

Nothing can keep the BTFD spirit at bay in Europe this Thanksgiving morning.

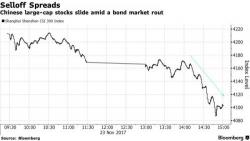

The euphoria from the year-end melt up in Europe and the US failed to inspire Chinese traders, and overnight China markets suffered sharp losses, with the Shanghai Composite plunging 2.3%, its biggest one day drop since June 2016, over growing fears that the local bond rout is getting out of control. Both the tech-heavy Chinext and the blue chip CSI 300 Index dropped over 3%, as the sharp selloff accelerated in the last hour, as Beijing's "national team" plunge protection buyers failing to make an appearance. There were sixteen decliners for every one advancing share.