Prepare To Be Put To Sleep By Draghi: Full ECB Preview

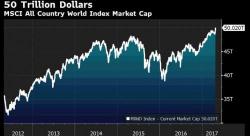

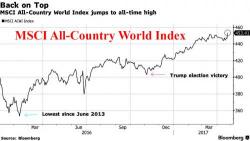

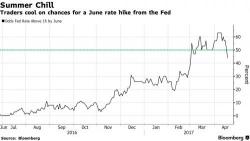

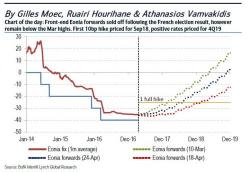

With the ECB set to announce its latest monetary policy decision in less than 12 hours, one can summarize in one word what the market expects: nothing. Sure, there are some nuances - the central bank may wax philosophical about Europe's better growth prospects, and maybe even set the stage for a small signal as early as June about an eventual reduction of stimulus, but don't count on it. After all, there is a reason - or rather two - why markets are where they are today, and it has to do with central banks creating a record $1 trillion in new money out of thin air.