Global Stocks Tumble; Gold, Safe Havens Jump On Doubts Trump Tax Cuts Will Pass

"Warning! US equities can occasionally go down as well as up a lot."

"Warning! US equities can occasionally go down as well as up a lot."

With the omnipotence of the world's central banks suddenly all too evidently exposed as nothing more than 'Oz'-like smoke-and-mirrors, it is not just US politicians that are losing faith and calling for more oversight of the most-powerful unelected officials in the world. Handelsblatt reports today that Germany's federal auditor says The ECB lacks accountability in banking sector oversight and government will work to close that oversight gap.

Authored by Don Quijones via WolfStreet.com,

If the ECB scales back stimulus, banks face even greater risk of collapse. But now there’s a new solution

A few weeks ago, Mario Draghi, the president of the ECB, and ECB member Weidmann confirmed the interest rates would continue at a relatively low level as this would be very helpful for the governments of Eurozone countries to get their finances back under control. This indeed seemed to be absolutely necessary to us, and in a previous column we already pointed out the devastating impact on the public finances should the interest rates on government debt increase by 1-2% on average.

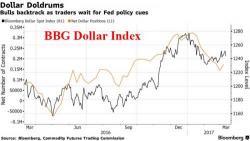

European bourses advance and Asian share rose led by a surge in Hong Kong stocks which rose the most in three months as Japan hit 15 month highs. U.S. futures are little changed along while the dollar rebounded from session lows after Friday's selloff. Crude oil has continued its retreat, down 0.2% and sliding for a 6th straight day after breifly dropping below $48 in overnight trading.