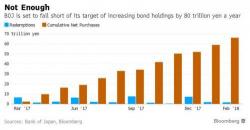

Japan Begins QE Tapering: BOJ Hints It May Purchase 18% Less Bonds Than Planned

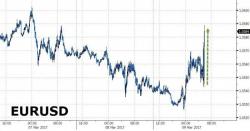

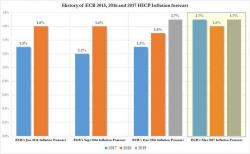

With the Fed expected to further tighten financial conditions following its now guaranteed March 15 rate hike, and the ECB recently announcing the tapering of its QE program from €80 to €60 billion monthly having run into a substantial scarcity of eligible collateral, the third big central bank - the BOJ - appears to have also quietly commenced its own monteary tightening because, as Bloomberg calculates looking at the BOJ's latest bond-purchase plan, the central bank is on track to miss an annual target, by a substantial margin, prompting investor concerns that the BOJ has commenced its ow