How The ECB Trapped Itself In A "Catch 22"

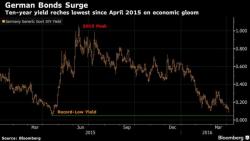

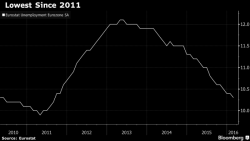

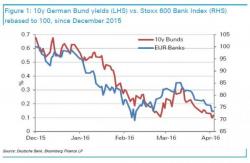

With speculation of helicopter money in Europe spreading like wildfire, here is a simple summary of how the ECB may have no choice but to go with the "final solution" and engage the "chopper" for one simple reason: by pushing bond yields lower, the ECB is now actively impairing the functioning of Europe's banks, and it's getting to the point where European bank stocks are now back to crisis lows, leading to questions about their viability. Here is the explanation courtesy of DB's Jim Reid.