JPM Looks At Draghi's "Package," Calls It "Solid," But Underwhelming

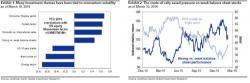

Earlier this month, JPMorgan’s Jan Loeys revealed that the bank is underweight equities “for the first time this cycle.”

Why? Well, allow Jan to explain it to you:

Earlier this month, JPMorgan’s Jan Loeys revealed that the bank is underweight equities “for the first time this cycle.”

Why? Well, allow Jan to explain it to you:

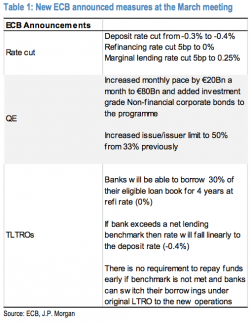

Three weeks ago, when looking at the incoming Q4 results, we were stunned by an unprecedented divergence: that of GAAP and non-GAAP earnings. We showed this difference as follows:

... and noted that while on a non-GAAP basis, the S&P's trailing P/E is a relatively rich 16.5x (over 17x as of today), it was the GAAP P/E that was troubling, because at just 91.5 in actual S&P EPS, this implies that the GAAP P/E of the overall market is now a near-record 22x.

We showed the delta between GAAP and non-GAAP as follows:

Submitted by Ben Hunt via Salient Partners' Epsilon Theory blog,

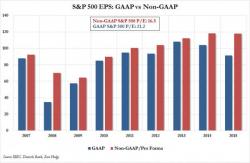

With regard what's happening in Europe, we've seen this movie before.

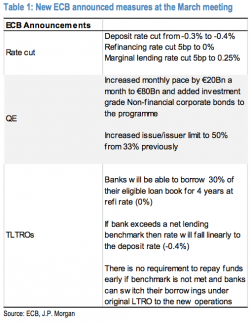

Last week it was all about the ECB, which disappointed on hopes of further rate cuts (leading to the Thursday selloff) but delivered on the delayed realization that the ECB is now greenlighting a tsunami in buybacks (leading to the Friday market surge). This week it is once again all about central banks, only this time instead of stimulus, the risk is to the downside, with the BOJ expected to do nothing at all after the January NIRP fiasco, while the "data dependent" Fed will - if anything - hint at further hawkishness now that the S&P is back over 2,000.

In the aftermath of Friday's market "reassessment" and subsequent surge, when the ECB's "bazooka" was found quite stimulative for risk assets after all (as opposed to the Thursday post-kneejerk reaction) one would think that Goldman which still has a 2,100 year end target on the S&P500, would be delighted.